Earning and managing CPE credits is a large task. You have to decide which courses to take, make sure they meet the necessary requirements, work the courses into your schedule, manage your credits, and report your credits. It can be overwhelming, especially if you’re new to CPE. So, we’ve put together a guide that covers the following:

- What are CPE credits?

- The difference between CE and CPE

- How to decide between CPE online courses and in-person courses

- How to decide between self-study and live courses

- How to decide between paid and free courses

- How to choose a CPE provider

- How to manage your CPE credits throughout the year

- What do you get with Canopy Courses?

- What topics do Canopy CPE courses cover?

- Sign up for free CPE online courses

After you review this guide, we hope you’ll feel better equipped to manage your CPE credits on a yearly basis. Let’s dive in.

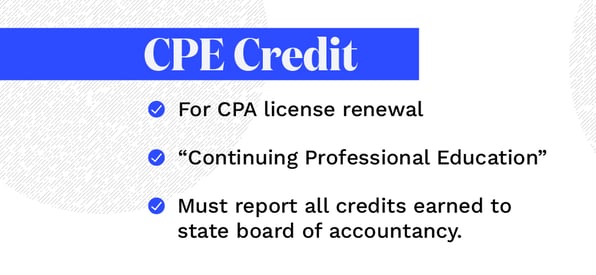

What are CPE credits?

CPE stands for “continuing professional education” and it’s required for CPA license renewal in every state. The standards are set by each state, so the number of required credits and the reporting periods will differ. Your state’s board of accountancy will require you to report all the CPE credits you earn.

Find how many CPE credits your state requires.

All state boards of accountancy will accept credits approved by NASBA (National Association of State Boards of Accountancy) to some extent, but some states may have additional requirements or limitations. Your state board can provide details about the type of CPE credits you need to maintain your CPA license and may even link to approved providers.

Visit your state’s website to get more information about what you need to stay eligible.

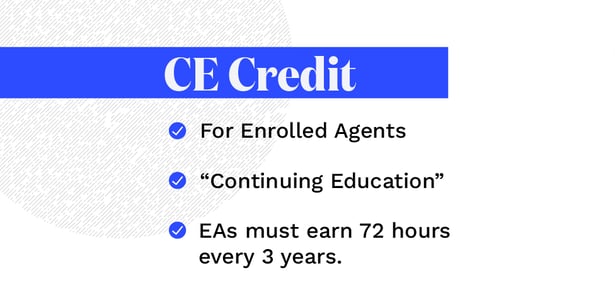

What’s the difference between CE and CPE?

CE or "Continuing Education" is for enrolled agents. EAs must earn 72 hours of CE credits every three years to maintain their EA status. At least 16 of those hours must be earned per year, and two of those CE credits need to be in ethics courses.

Not every tax course will qualify for IRS CE credits as the classes and the providers must be approved by the IRS. When an EA completes an IRS-approved CE course, the provider reports it on their behalf to the IRS.

Should you sign up for CPE online courses or in-person courses?

You’ve probably noticed a significant increase in the availability of online CPE courses. After all, with advances in modern technology, virtual classrooms are as easy as turning on the computer. But how effective is online learning when compared to in-person CPE courses?

Before deciding on what’s best for you, take some time to look at both the benefits and drawbacks of each educational delivery method.

A closer look at in-person CPE courses

Traditional, in-person CPE courses offer the advantage of face-to-face interaction. This is especially suited to topics that you have a lot of questions about. When you take an in-person course, you get to connect with both the instructor and your classmates. Networking like this can bring unexpected benefits for you professionally and personally. Also, some people simply learn better in a live setting and a more structured classroom.

On the other hand, in-person courses often require commuting or travel, which can be inconvenient, especially during your busy seasons. With in-person courses, you are also limited to locations that you can get to. If the ideal class is too far away or too expensive to get there, you are out of luck and must find something more local to fit your needs.

In-person classes also mean that you are at the mercy of the CPE provider’s schedule. It’s not often that you can choose the dates and times that are most convenient for you.

A closer look at CPE online courses

The main advantage for CPE online courses is their flexibility. When you have a busy schedule, you want the ability to control when you attend a class and for how long. Online classes have a true global reach in that they can be accessed anytime from anywhere in the world. All you need is a quiet space and a good internet connection.

You can also progress at your own pace with online courses. If there is a concept you want to revisit, you can simply go back to that part without interfering with the instructor or inconveniencing classmates. There’s no limit to the specific topics you can access with online classes, so you have the luxury of selecting the courses that will serve you best. Additionally, you’ll have easy access to classes from industry recognized thought leaders.

The downside of online CPE courses is that they require self-motivation and self-discipline to complete. Because there is less accountability than attending an in-person course, you’ll need to make it a priority to log in and go through the course.

Clearly there are both advantages and disadvantages with online vs. in-person CPE courses. However, instead of asking yourself which method is better, you should focus on which method best suits your current needs.

Should you take self-study or live CPE courses?

While both self-study and live CPE courses are offered online, each one has unique features that may suit you better at certain times of the year. Each year, many accounting professionals like you make decisions about whether self-study vs. live courses are better for them.

Pros and cons of self-study CPE options

Don’t underestimate the quality of today’s self-study courses. Not only are they readily available online, they are often better suited to the self-disciplined accounting professional who wants to tackle CPE any time of the day or night. Check out a few of the pros and cons of taking online self-study CPE courses:

PROS

There’s no webinar time to tune into with a self-study program. Whether it’s early in the morning, late at night, or on a weekend, you’ll be able to participate when you want for as long as you want.

Taking online classes allows you to go through the material at your own pace. You can spread out the material over time or speed up to finish more quickly. It meshes perfectly with any schedule.

If you are the type of person who likes to highlight, underline, and scribble notes, many self-study programs are available as hard copies.

CONS

It can be a real challenge to motivate yourself to get through the coursework when so many other things demand your attention.

Self-study courses are often set up so that you only need to finish them within a certain amount of time. For example, the NASBA standard allows up to a full year to finish from the date of purchase. This could leave you scrambling if you put it off too long.

Pros and cons of live CPE options

Live CPE courses are generally done via webinar. Participants log in at the appropriate time from their location to participate. Also, live courses generally require some kind of formal interaction to ensure attendance and that you are paying attention. Here are some of the pros and cons of enrolling in live courses:

PROS

Many live courses in webinar format require some interaction from you before, during, and after. This may be in the form of questionnaires, surveys, polls, and quizzes. Your participation shows that you are present and listening.

For many, having a set time and day to log into a webinar means you will get it done and keep moving forward with the class until you finish. There’s no putting off certification with a course that requires your attendance to finish.

With a live webinar instructor, they can discuss and teach about the latest information. Other methods may take a little longer to produce, so the information isn’t always the most current.

If the webinar Instructor is dynamic and personable, they may be able to keep your attention for hours. Also, they usually incorporate graphics, videos, and more. When it comes to retaining information, a live CPE webinar may help you stay focused.

CONS

Participants in live courses must complete their coursework within the timeframe allowed by the class. If you have to miss a scheduled webinar for any reason, you’ll miss the information and you won’t get credit. Additionally, if you are not present for a full 50 minutes of a 60-minute presentation, you won’t get credit.

A great live CPE course will educate you, but a lousy webinar will make you want your money back. Differences in Instructors and problems with technology (such as dead air or graphics issues) can detract from learning and waste your time.

Should you pay for CPE courses?

When it comes to actually attending your annual CPE credit courses, you want the right combination of quality and affordability. After all, if you are going to spend your valuable time attending, it needs to be worth it.

Free vs. paid CPE options

Free CPE courses and paid CPE courses have different reputations. Here are just a few of the things accounting professionals find with many of the free CPE courses out there:

- Free courses can be an inexpensive and fast way to claim some credits without adding expenses.

- Few companies give out their most valuable information for free, so the free courses are usually not on topics that are in high demand.

- Online courses or webinars that are free may have questionable technical quality, lower quality graphics, and less than stellar Instructors.

When it comes to paid CPE courses, there’s generally more quality but the higher prices can be real budget busters. Here are a few findings from accounting professionals on many paid CPE courses:

- Paid content is more likely to be on topics relevant to your needs.

- The production quality of paid courses presented as webinars is generally better, with fewer technological glitches.

- May be presented as paper-based, self-study books that are both boring and expensive.

- Too many bells and whistles may be included to justify the cost of the course.

- The cost may include features that you don’t want or need, such as access to reference materials or discounts on related CPE courses in the future.

It’s possible to combine low cost and high quality

More free and paid CPE courses are hitting the market each year. Wish you could find something that perfectly balanced cost and quality? Would it be too much to ask if the courses were relevant, efficient and educational, too? The good news is Canopy recognizes most CPAs don’t want to face that frustrating either-or choice anymore.

We are one of the few companies to offer free or low-cost CPE options that also deliver high quality information presented by leading industry experts.

Using the latest webcasting technology and dynamic instructors with helpful information, we put a lot of effort into focusing on your professional needs.

If you are tired of choosing between frustrating free CPE courses and breaking the bank for those expensive paid courses, consider Canopy Courses.

How do you choose a CPE provider?

Why does the CPE provider matter?

The CPE provider can be a huge asset or an obstacle to success. In many ways, the provider is just as important as a course’s content, instructor, cost, and certification. After all, the provider associated with the webinar, self-study course, or other method determines the user experience.

Online learning can be a real pain when there are glitches in ordering and making an electronic payment, delivery of the course, etc. Without a good provider, you may struggle with many aspects of the course, from wading through an inefficient presentation or digital textbook to leaving the course with more questions than answers.

Above all, the technology must enhance the CPE courses and your learning experience. With a stellar delivery platform, you can get the education you need in the most effective and stress-free way.

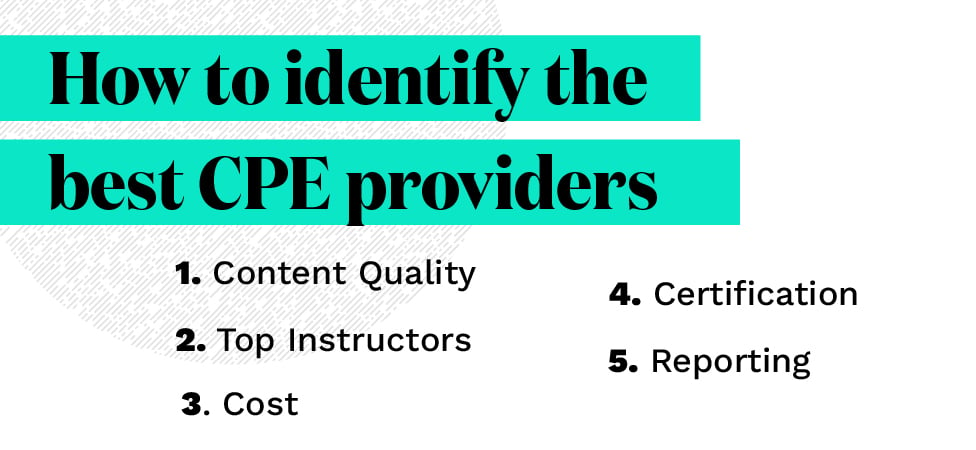

How to identify the best CPE providers

It isn’t difficult to spot the best courses out there. All it takes is a careful assessment of the provider and an evaluation of what the course offers. Here are the top five things to check out when evaluating a provider’s courses:

- Content quality: You need current information to help yourself and your clients out. Therefore, you can’t afford to waste your time on courses with limited relevancy.

- Top instructors: The best instructors go beyond reading slides of information. They are engaging, experienced and highly qualified to teach you what you need to know. Blending real-world experience with the latest information, instructors are a key component of quality CPE courses.

- Cost: A provider may have the most incredible courses available, but if you can’t afford them, then you lose out. Remember that high cost doesn’t automatically mean high quality. There are plenty of affordable CPE courses available that will meet your needs.

- Certification: Too many providers offer courses that don’t hold any type of national certification. Without being approved by a reputable national body, the courses are not worth your time and will not satisfy your licensing requirements. Always look for courses that are approved by NASBA or your state’s licensing body.

- Reporting: Providers of the best courses provide a certificate of completion so you can report your credits to your state. Too many providers leave it all up to you.

How do you manage your CPE credits throughout the year?

When it comes to tracking CPE credits, it’s easy to become overwhelmed. Without proper management, you can quickly get behind in what you need to renew your state license. Because improperly managing all your CPE options can seriously affect your business, it’s a good idea to develop a strategy to stay on track.

Choose from available CPE options

You have thousands of hours of courses to choose from, including CPE online courses and in-person courses. You can even earn CPE credits by attending certain trade shows and events. As you look at the year ahead, take note of the courses you are interested in. The criteria to decide should be based on location, cost, topic, style, and whether it fulfills CPE credits.

Once you’ve selected the CPE courses that interest you, schedule them out in advance. Many CPAs like to create a spreadsheet or digital calendar where they can plug in deadlines, payment schedules, and reminders.

Look behind and ahead

Do you know how many credits you need and when you need to earn them? Does your state have an annual minimum of credits that you have to meet? Did you accurately track and report the credits you’ve already earned?

Good record-keeping is essential. Knowing the big picture in this way gives you a roadmap of where you are and where you are going. You’ll also be able to avoid the end-of-year scramble for courses when you are stretched thin on time and money.

Commit to regular study time

The hardest part about CPE courses that are self-study or online is finding the time to simply do the work. You might find it helpful to schedule out blocks of time in your week or month to dedicate to study. Whether it’s a two-hour block once per week or taking a day off once per month to study, you’ll be more efficient and effective in completing your CPE coursework.

Use tracking software

There are many different types of CPE tracking software on the market that you can use to manage all your CPE options annually. All you do is input your information on reporting requirements when you finished the course, and how many credits you earned. If you have several CPAs at your firm, you can even organize databases for several different people over multiple years.

Last-minute CPE options

If despite your best efforts, you still haven’t managed to earn all the CPE credits you need by the end of the year, there are usually some courses offered at the end of December or even in the first few weeks of January. It may be difficult to earn a lot of credits in a hurry but there may be a part-day or all-day course that will deliver what you need.

Tracking saves time and stress

Earning CPE credits is vitally important to the success of your business and to your professional development. It’s too easy to lose track of the number of credits, the deadlines, and the types of credits you need. To stay compliant and avoid a last minute scramble to earn credits, implement a strategy for tracking credits.

What do you get with Canopy Courses?

For many accountants, receiving their required CPE credits can be a costly, time-consuming endeavor. At Canopy, we offer affordable, easy-to-access, CPE and CE courses. Each course, presented by top experts in the industry, is meticulously created to deliver high-quality tax, accounting, and non-technical information. Canopy Courses also lets you choose between webinar and self-study options, so you can receive your CPE credits when and how you want to.

With Canopy Courses you will get:

- Premium content

Interesting and current technical and non-technical information. - Top instructors

Experienced and engaging teachers offer high quality, real-world experience with the latest information delivered via on-demand webinars and self-study courses. - Certification

All courses are accredited by NASBA and/ or the IRS. - Reporting

All completed hours of CE courses are directly reported to the IRS and a certificate of CPE completion is instantly provided so professionals can easily report their credits to their state’s licensing body. - Intuitive online platform

Simple, easy-to-use site that provides a seamless user experience for continuing education.

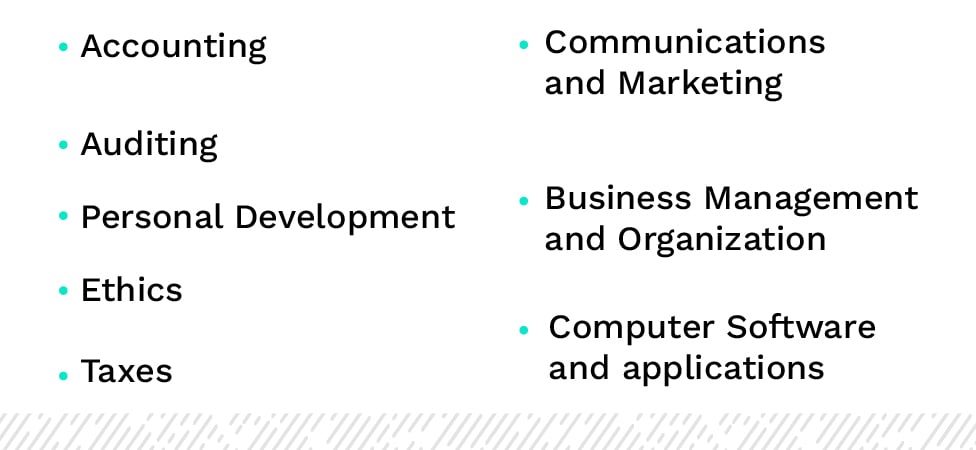

What topics do Canopy CPE courses cover?

Canopy Courses covers a wide range of CPE topics, from taxes to personal development, marketing, and more. So, no matter your interests or level of experience, there is sure to be something for you. These various topics will make you more competitive in the industry, all while fulfilling the required CPE credits. The course topics fall into the following categories:

To help you better navigate our courses, we’ve created a list of CPE courses we currently offer.

Accounting

Introduction to Forensic Accounting

Instructor: Robert K. Minniti

Credit Hours: 1

Introduction to Governmental Reporting

Instructor: Carol Hsieh

Credit Hours: 1

Auditing

Blockchain Applications for Accounting, Audit, & Tax

Instructor: Sean Stein Smith

Credit Hours: 1

Business Management and Organization

Challenges with Running a Virtual Practice

Instructor: Jason Blumer

Credit Hours: 1

Organizational Culture Development

Instructor: Jon McNaughtan

Credit Hours: 1

5 Reasons Your Practice Isn't Growing

Instructor: Jason Blumer

Credit Hours: 1

Succession Planning

Instructor: Lindsay Stevenson

Credit Hours: 1

Grow Your Practice By Adding Tax Resolution Services

Instructor: Roger Thaxton

Credit Hours: 1

Mergers & Acquisitions for CPA Firms

Instructor: Bill Carlino

Credit Hours: 1

Communications and Marketing

What Is the ROI of Marketing?

Instructor: Karen Reyburn

Credit Hours: 1

Audience: Who Is Your Marketing For?

Instructor: Karen Reyburn

Credit Hours: 1

Campaigns: What Specific Marketing Will You Do?

Instructor: Karen Reyburn

Credit Hours: 1

The Gig Economy

Instructor: Janet Berry-Johnson

Credit Hours: 1

Building a Local Listings Engine for Your Tax Practice

Instructor: Nate Hagerty

Credit Hours: 1

Tracking & Analytics: How to Measure Your Marketing Results

Instructor: Karen Reyburn

Credit Hours: 1

Social Media Marketing for Accountants

Instructor: Karen Reyburn

Credit Hours: 1

Computers and Applications

Microsoft Excel: Shortcut Keys & Ninja Tricks

Instructor: JDee Itri

Credit Hours: 1

Microsoft Excel: Fun with Functions

Instructor: JDee Itri

Credit Hours: 1

Ethics

Managing Ethical Dilemmas

Instructor: Robert E. McKenzie

Credit Hours: 2

A CPA’s Guidebook for Ethical Behavior for Texas CPAs

Instructor: Allison McLeod

Credit Hours: 4

AICPA Regulatory Ethics Part 1

Instructor: Allison McLeod

Credit Hours: 1

AICPA Regulatory Ethics Part 2

Instructor: Allison McLeod

Credit Hours: 1

AICPA Regulatory Ethics Part 4

Instructor: Allison McLeod

Credit Hours: 1

Information Technology

Cyber Security Part 1

Instructor: Tanya Baber

Credit Hours: 2

Cyber Security Part 2

Instructor: Tanya Baber

Credit Hours: 2

Personal Development

Becoming an Enrolled Agent

Instructor: Eva Rosenberg

Credit Hours: 1

Personnel/Human Resources

Strengthening Seasonal Employees

Instructor: Jon McNaughtan

Credit Hours: 1

Taxes

Independent Contractor vs. Employee Part 1

Instructor: Tanya Baber

Credit Hours: 1

Independent Contractor vs. Employee Part 2

Instructor: Tanya Baber

Credit Hours: 1

1099 Form Instructions for Practitioners Part 1

Instructor: Tanya Baber

Credit Hours: 1

1099 Form Instructions for Practitioners Part 2

Instructor: Tanya Baber

Credit Hours: 2

1099 Form Instructions for Practitioners Part 3

Instructor: Tanya Baber

Credit Hours: 1

Trust Fund Recovery Penalty Basics

Instructor: Tanya Baber

Credit Hours: 1

Employment Tax Basics

Instructor: Tanya Baber

Credit Hours: 1

Virtual Currency & Taxation Part 2

Instructor: Amy Wall

Credit Hours: 2

Virtual Currency & Taxation Part 3

Instructor: Amy Wall

Credit Hours: 1

Ministers & Clergy Tax Rules

Instructor: Tanya Baber

Credit Hours: 1

IRS Penalty Abatement Basics

Instructor: Tanya Baber

Credit Hours: 1

IRS Penalty Abatement Advanced

Instructor: Tanya Baber

Credit Hours: 2

IRS Offer in Compromise Basic

Instructor: Tanya Baber

Credit Hours: 1

IRS Offer in Compromise Intermediate

Instructor: Tanya Baber

Credit Hours: 2

IRS Offer in Compromise Advanced

Instructor: Tanya Baber

Credit Hours: 2

Micro-business Taxation and Consulting Part 1

Instructor: Amy Wall

Credit Hours: 1

Micro-business Taxation and Consulting Part 2

Instructor: Amy Wall

Credit Hours: 1

Micro-business Taxation and Consulting Part 3

Instructor: Amy Wall

Credit Hours: 1

Tax Litigation Essentials

Instructor: Joshua Wu

Credit Hours: 1

Emergency Strategies for Stopping Collection

Instructor: Dan Pilla

Credit Hours: 1

FBAR Basics and Form 8938

Instructor: Paul Hogue

Credit Hours: 1

Audit Defense Strategies and Negotiating with the IRS Part 1

Instructor: Dan Pilla

Credit Hours: 1

Audit Defense Strategies and Negotiating with the IRS Part 2

Instructor: Dan Pilla

Credit Hours: 1

U.S. Expatriate Taxation

Instructor: Roger Healy

Credit Hours: 1

Responding to the Most Common IRS Notices

Instructor: Jeff McNeal

Credit Hours: 1

Section 199A Small Business Deduction Overview

Instructor: Tanya Baber

Credit Hours: 1

New Qualified Business Income Deduction: Section 199A

Instructor: Kris J. Thiessen

Credit Hours: 1

Section 199A SSTB and Qualified Business

Instructor: Tanya Baber

Credit Hours: 1

Section 199A Final Regulations

Instructor: Tanya Baber

Credit Hours: 1

Self Employment Tax

Instructor: Mark Bliss

Credit Hours: 1

Examining Currently Not Collectible Types and Uses

Instructor: Jeff McNeal

Credit Hours: 1

When an Audit Becomes Criminal

Instructor: Joshua Wu

Credit Hours: 1

Intro to Tax Resolution Part 1

Instructor: Tanya Baber

Credit Hours: 1

Intro to Tax Resolution Part 2

Instructor: Tanya Baber

Credit Hours: 1

Simplifying Tax Resolution Cases with Canopy

Instructor: Jeff McNeal

Credit Hours: 1

Subchapter S Corp Basics

Instructor: Amy Wall

Credit Hours: 1

Sign up for free CPE online courses

Ready to start earning CPE credits with Canopy?

Sign up here to get access to dozens of webinar and self-study courses.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.