This year has brought a handful of changes to both the enrolled agent (EA) exam and continuing education (CE). Just so you can know what to expect, let’s take a closer look at each one of the changes outlined by the IRS.

Special Enrollment Examinations will begin May 1st, 2021.

Prometric will begin SEE testing next month, and all Prometric testing centers will be complying with local, state, and federal guidelines to ensure the health and safety of employees and test takers. All test takers will be required to wear a mask for the entirety of their time in the testing center. Test takers who show up without a mask will not be permitted to take the exam.

Additionally, if you have scheduled your test for May 1st, 2021, your appointment may be impacted due to government safety guidelines or space availability. If this is the case, you will receive a series of emails with your new suggested appointment date and instructions on what to do if that time does not work for you.

The IRS will be conducting EA continuing education audits.

Beginning in mid-April this year, the IRS will begin sending out letters to a randomly-selected group of EAs requesting copies of their CE certificates from the past three years. This is a result of a 2018 audit that concluded with four main findings, namely that EA

- Were unable to provide certificates of completion to substantiate their completed CE hours

- Didn’t provide a PTIN or provided an incorrect PTIN to CE Providers during registration/sign-in

- Didn’t retain certificates of completion for the required four-year period

- Didn’t use an IRS-approved CE Provider

EAs that receive an audit letter from the IRS will have 60 days to either fax or mail in the requested documents.

Stay caught up with your 2021 CE requirements and avoid any auditing trouble by taking unlimited, free courses through our CE platform.

Special Enrollment Exam test scores will be delayed during the beta period.

If you decide to take your SEE between May 1st and roughly August 1st this year, you will not be able to immediately see your test results or a score report after completion of the exam. The reason for this is so data can be collected and analyzed in order to determine the passing score based on new testing specifications. Anyone who completes the exam during this time will be able to review their test results beginning August 5th.

Beginning August 2nd, a new feature will be implemented which will allow candidates to immediately see a pass/fail message upon completion of the exam. An email containing a more detailed score report will also be emailed to the candidate.

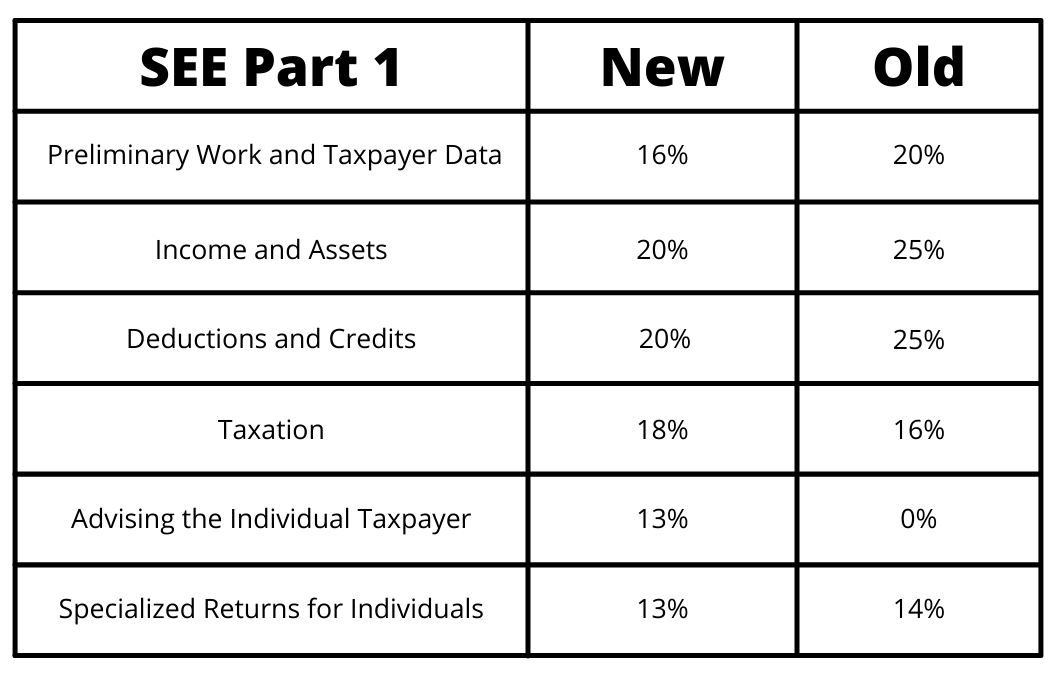

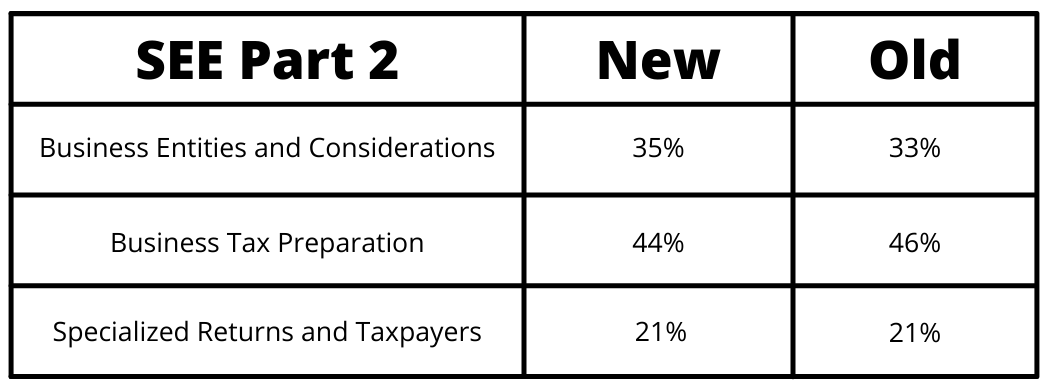

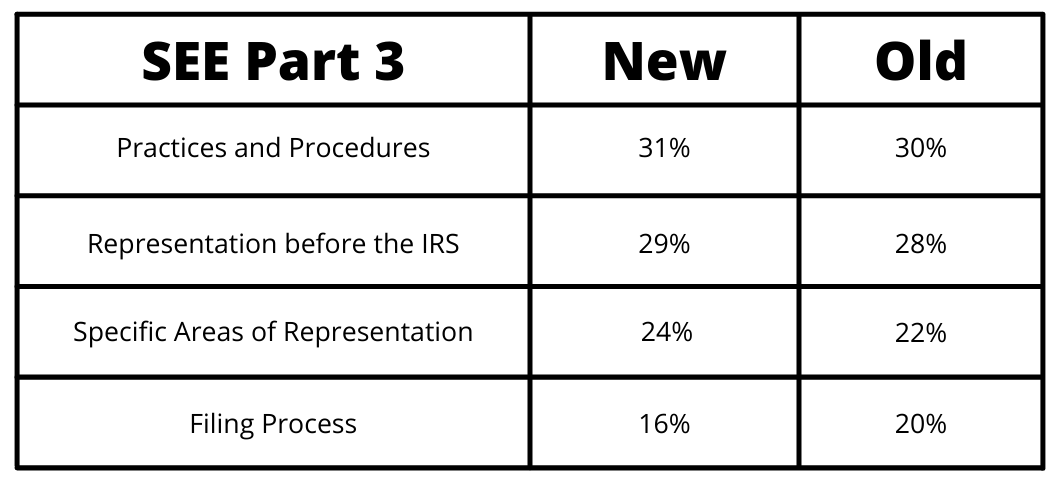

The IRS updated the weighting system of SEE exam domains.

The IRS commissioned a job analysis of thousands of enrolled agents in comparison to responses by professional testing experts. This was to ensure that the skills and knowledge necessary to be an EA were accurately reflected in the various domains of the exam.

As a result, starting May 1st, there will be changes in the weight of each section of the exam. You can see the changes in the charts below:

The rollover period for SEE candidates increased from 2 years to 3 years.

In the past, candidates who pass a part of the examination can carry that passing score for up to two years from the date they passed that exam. In response to the global pandemic and to provide more flexibility to candidates, that number has now been increased to 3 years.

IRS to terminate/inactivate EAs who haven't renewed.

EAs with SSNs ending in 4, 5, or 6, who have not renewed for both the 2017 and 2020 cycles will have their enrollment placed in terminated status. Anyone in terminated status must retake the SEE to apply for re-enrollment.

EAs with SSNs ending in 4, 5, or 6, who did not renew for the 2020 cycle will have their enrollment placed in inactive status. Anyone in inactive status can still submit a late renewal for approval; with proof of CE.

Continuing Education Credit can be earned for Data Security Courses.

Tax professionals can now earn CE credit for programs covering data security and identity theft topics. Courses focused on enhancing tax professional awareness of protecting client data, including review of Publications 4556 or 4524 safeguards can qualify for continuing education in the federal tax law category.

For more detailed descriptions of each of these changes, visit the Enrolled Agents section of the IRS website at https://www.irs.gov/tax-professionals/enrolled-agent-news.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.