Your tax practice will expose you to clients with a wide variety of tax problems. One particular problem that often comes up is when one spouse believes they have been unjustly affected by the other spouse’s tax liability. Married taxpayers that file joint tax returns are jointly and legally liable for any resulting tax debt or liability. Since this can significantly affect the financial situation of married taxpayers who file jointly, the IRS introduced Innocent Spouse Relief.

Types of Innocent Spouse Relief

There are two types of relief provided by the IRS for a spouse who encounters this problem:

In this post we will focus on Innocent Spouse Relief, as it is the most common of the two types.

When two spouses file a joint return, the IRS views both parties as jointly liable for any tax due. However, if one spouse believes that they should not be liable and/or should not be forced to pay for the tax due, then they can apply for Innocent Spouse Relief. This type of tax relief allows a joint-filer to be relieved of the responsibility of paying (or partially paying) tax, interest, and penalties if the other joint-filer improperly reported items on the jointly filed tax return.

This type of tax relief allows a joint-filer to be relieved of the responsibility of paying (or partially paying) tax, interest, and penalties if the other joint-filer improperly reported items on the jointly filed tax return.

Qualifying for Innocent Spouse Relief

In order to qualify for Innocent Spouse Relief, all of the following requirements must be met:

1. The taxpayer filed a joint return which has an understatement of tax due to erroneous items reported by the other joint-filer. A joint return must have been filed or else the taxpayer will not qualify for relief.

A joint return must have been filed or else the taxpayer will not qualify for relief.

2. The taxpayer established that at the time they signed the joint return they did not know, and had no reason to know, that there was an understatement of tax. This generally means that the taxpayers owed more tax than what they reported on their tax return. Additionally, this understatement must be from erroneous items reported, such as: incorrectly reported income, improper deductions/credits, overclaims of exemptions, etc.

The taxpayer must be able to show that they did not know and could not have been expected to know that something was amiss with their tax reporting.

3. Taking into account all the facts and circumstances, it would be unfair to hold the taxpayer liable for the understatement of tax. The taxpayer must be able to show that they did not know and could not have been expected to know that something was amiss with their tax reporting.

To determine this, the IRS will look at the financial situation, business experience, educational background, etc. of the taxpayer applying for Innocent Spouse Relief in order to determine whether they should have known about the problem. They will also look at the tax return and tax history of the taxpayers to see whether this is a recurring error and how it compares to their overall tax return. If it was clear on the face of the tax return that there was an error with the return, it will be difficult to obtain relief. To give your client the best chance of having their application accepted by the IRS, ensure that your client includes all relevant facts, including the current status of the marriage and whether your client has any experience with tax matters.

Ensure that your client's application includes all relevant facts, including the current status of the marriage and whether your client has any experience with tax matters.

4. The taxpayer and their spouse (or former spouse) have not transferred property to one another as part of a fraudulent scheme. A fraudulent scheme includes a scheme to defraud the IRS or another third party, such as a creditor, ex-spouse, or business partner.

All four of these requirements must be shown in the taxpayer’s application for Innocent Spouse Relief. The application must present a strong case with adequate documentation and proof to be accepted.

Applying for Innocent Spouse Relief

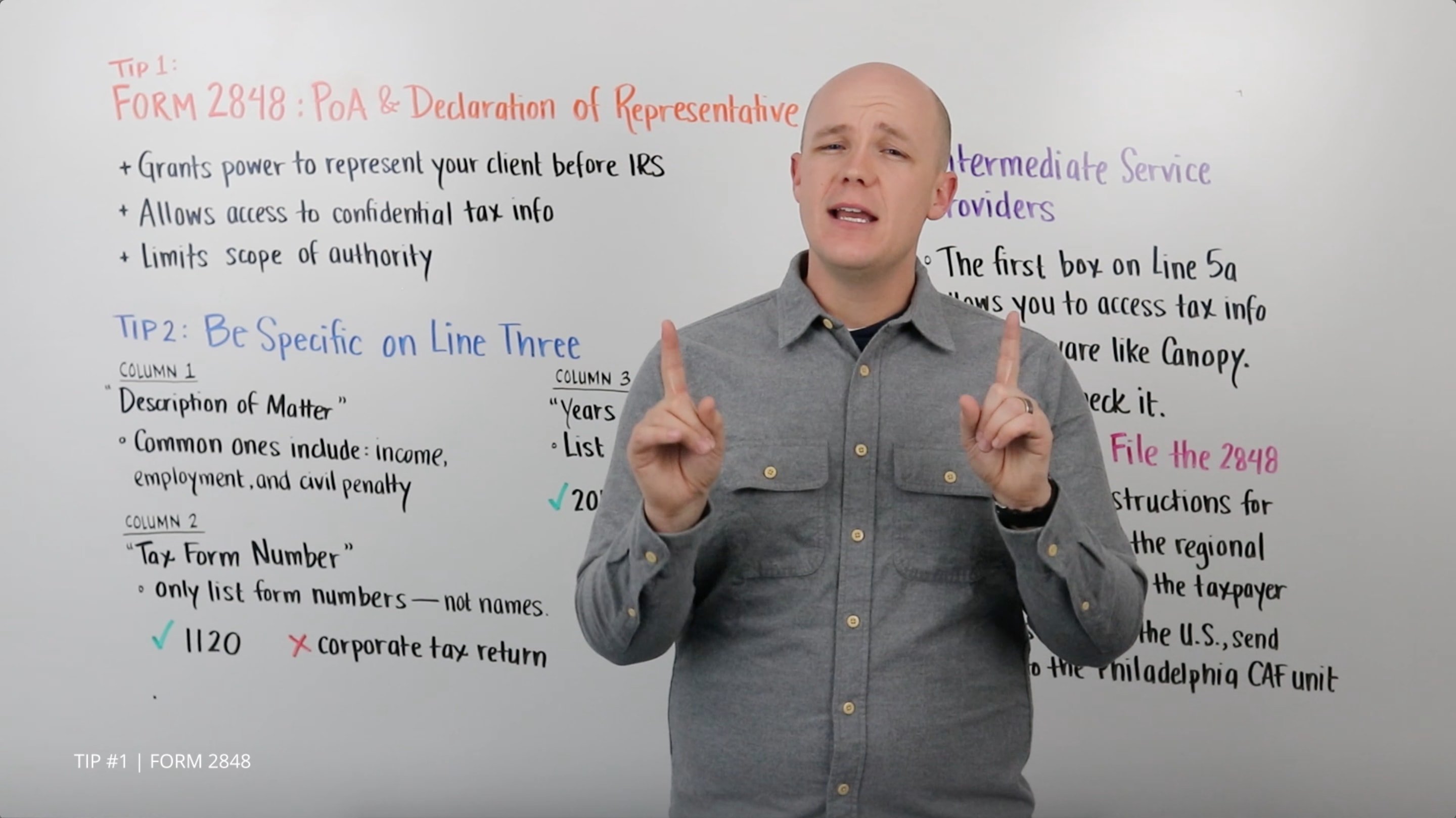

After you have determined that your client meets all of the above qualifications, you must submit an application for your client using Form 8857. This four-page document will include many questions regarding the taxpayer’s unique situation and why they qualify for relief. The taxpayer must clearly show how their situation satisfies each prong of the requirements listed above.

Using the information you provide, the IRS will determine whether the taxpayer had the capability or should have known based off the circumstances that there was something wrong with their tax filing.

As Tax Day approaches, it is important to be aware of this relief option for your clients filing jointly. Clients with tax debt are already under a significant amount of stress as it is. Providing viable options for tax relief can be a significant and important part of your tax practice and earn you clients for life.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.