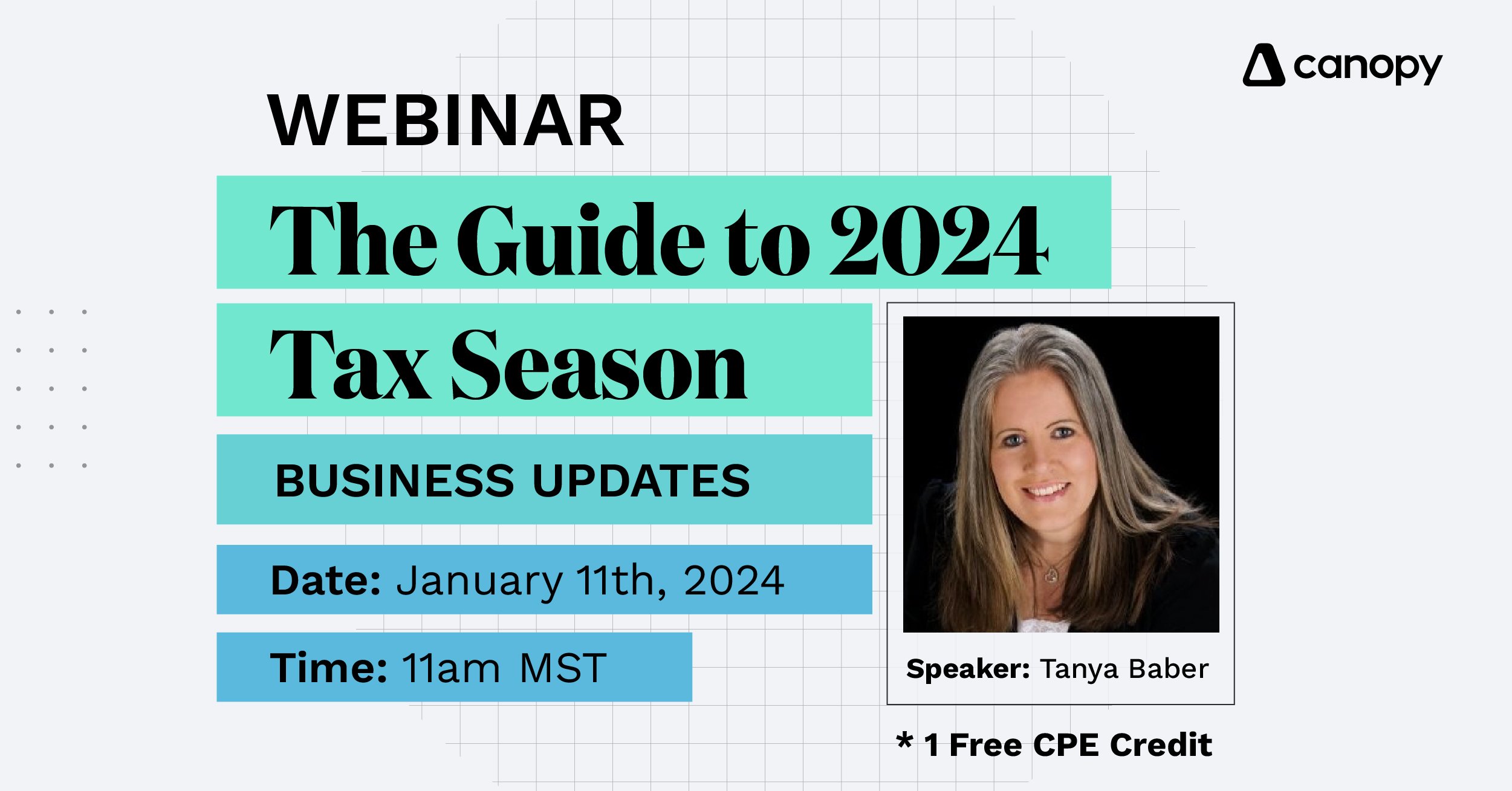

Join for 1 Free CPE Credit

Speaker: Tanya Baber

In this second part of our 2023-2024 tax update series, we will cover rules that affect 2023 filing and effects of changes like SECURE 2.0 and the Inflation Reduction Act (IRA) rules effective January 1, 2023, as well as other provisions and changes affecting primarily business tax return clients. We will discuss Depreciation and deduction changes, a list of credits including those from the Inflation Reduction Act, and also changes that can affect business owner’s benefit and retirement programs and go over other changes that are caused by new inflation adjustments.

If you have wanted a comprehensive, easy to follow tax update course on the 2023/2024 tax law changes as they relate to businesses, this webinar is definitely for you!!

What you will learn:

- Comprehend 2023 bonus depreciation changes and their implications for 2024 onwards.

- Explore business-related credits.

- Understand new IRA Vehicle credits for businesses.

- Examine the impact of SECURE 2.0 on business retirement and benefit plans, including effective dates.

- Assess recent IRS announcements and their impact on penalties for recently filed tax years.