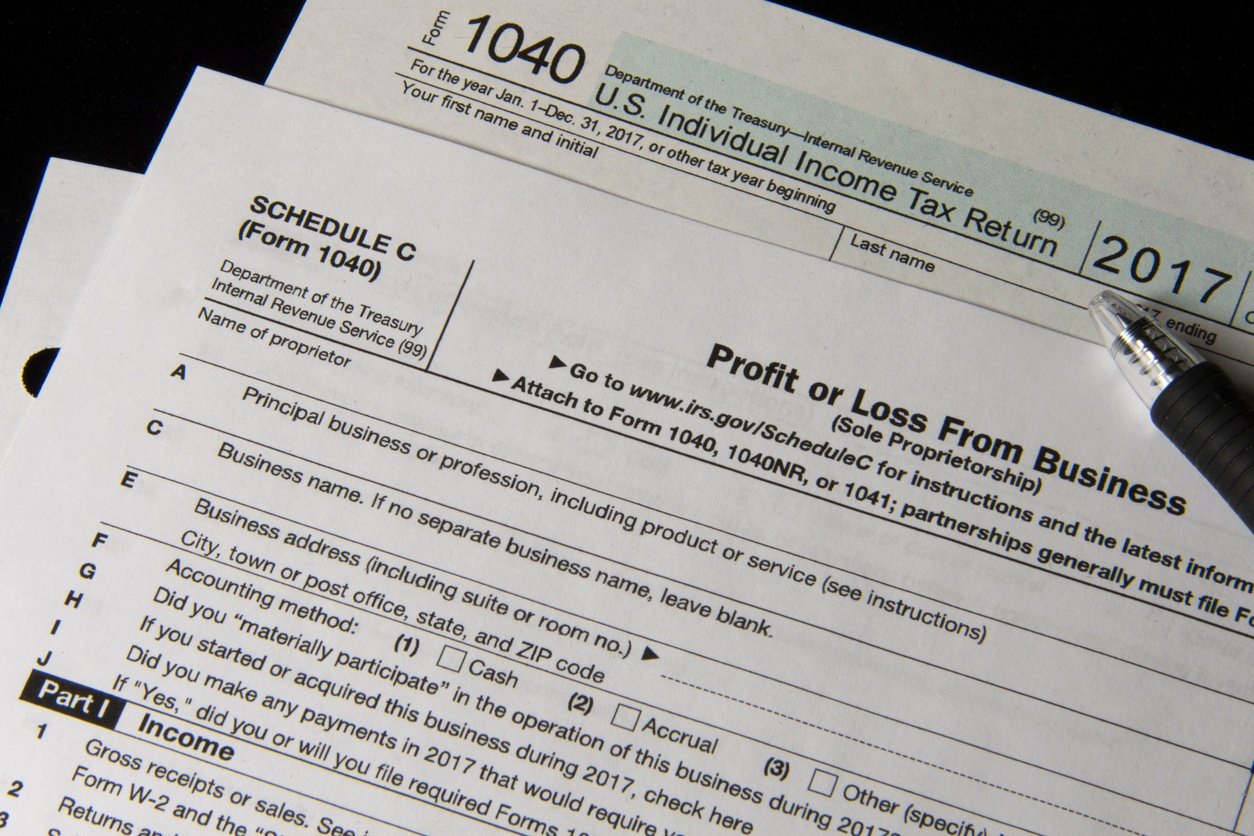

When it comes to paying income tax, the higher the income, the higher the tax. That’s why these high-income earners have several things to consider as they prepare their returns. Just as those with low incomes qualify for some different tax breaks, high income earners have tax breaks, too. As a tax professional, you’ll want to help your clients with a higher income take advantage of high-earner tax rules and issues that may qualify them to keep a little more of their hard-earned money.

Tax Brackets and Income Levels

Tax year 2021 was as bumpy as the previous year due to many changes (one due to a mid-year and retroactive tax bill that passed 3/11/21 as we were in the middle of tax season). In this eBook, we go over the main changes you need to know—from tax bracket inflation adjustments to changes in tax law—in order to be best equipped to help your clients this upcoming tax season.

For tax year 2021, there are seven tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Here are the tax brackets for the highest three income ranges:

-

-

- 32% tax rate: $164,926 to $209,425 (Single); $329,851 to $418,850 (Married Filing Jointly)

- 35% tax rate: $209,426 to $523,600 (Single); $418,851 to $628,300 (Married Filing Jointly)

- 37% tax rate: $523,601 and over (Single); $628,301 and over (Married Filing Jointly)

-

Generally, individuals that have a higher income are required to pay higher income tax as their earnings increase and as they move up to higher tax brackets. High-income individuals must navigate through quite a few issues when it comes to U.S. income tax. It’s important for you to be aware of the most common issues affecting high-income taxpayers so you can better serve your clients that fit into these highest tax brackets.

3 tax issues affecting high-income earners

We’ve compiled a list of common issues to consider for your high-income clients as tax season approaches.

1. Alternative Minimum Tax

The alternative minimum tax (AMT) is an additional tax imposed on taxpayers who have alternative minimum taxable income over a certain threshold. IRS Form 6251 is used to determine a taxpayer’s alternative minimum taxable income. In order to determine this income, certain itemized deductions and tax breaks are added back to adjusted gross income (AGI).

Here are the tax exemption amounts for tax year 2021:

Single Filers: $73,600

Married Filing Jointly: $114,600

Married Filing Separately: $57,300

Some of those deductions include:

-

-

- State and local income taxes

- Medical expenses

- Real estate taxes

- Personal property taxes

- Miscellaneous itemized deductions

- Interest on home equity loans

- Deduction for a net operating loss

-

Once these deductions and tax breaks are added back into the adjusted gross income, the taxpayer then subtracts an exemption amount. The exemptions phase out as the taxpayer’s income passes a certain threshold. Phasing out begins at the following levels:

Married Filing Jointly: $1,047,200

Single individuals, heads of households, married individuals filing separately: $523,600

After calculating the alternative minimum taxable income and subtracting the exemption, the remainder is subject to one of two tax rates. For the tax year 2021, the AMT tax rate is 26% if income was $199,900 or less ($99,950 or less if married filing separately) and 28% for income greater than those amounts.

Understandably, this tax can be very confusing for taxpayers who are required to fill out the form. You can help your clients navigate the AMT.

2. Net Investment Income Tax

Net investment income tax (NIIT) is assessed on “unearned income” at 3.8% if the taxpayer earns more than $250,000 (married filing jointly), $200,000 (single), or $125,000 (married filing separately). These rates are the same as in 2019 and they will not adjust unless Congress introduces new legislation to change them.

The unearned income includes:

-

-

- Interest

- Capital gains

- Royalties

- Rental income

- Dividends

- Non-qualified annuities

-

NIIT can be imposed on estates and trusts when the adjusted gross income passes a certain threshold. Those who are not U.S. citizens are not subject to NIIT.

In order to pay NIIT, taxpayers must calculate their modified adjusted gross income (MAGI). MAGI is adjusted gross income increased by the difference between amounts excluded from gross income under section 911(a)(1) and the amount of any deductions or exclusions disallowed. Individuals, estates, and trusts will use IRS Form 8960 to compute their NIIT.

3. Estate Tax

High-income individuals also need to plan for tax on their estates. Estate tax is a tax on the right to transfer property at the time of a taxpayer’s death. The total value of these items is called “Gross Estate” which is then reduced by certain deductions to arrive at the "Taxable Estate." The estate tax is imposed on an estate’s value that exceeds a certain exemption level.

For the 2021 tax year, this exemption is at $11.7 million for individuals. This means someone can leave that amount to someone and there would be no gift tax or federal estate tax. For married couples, that amount is $23.4 million. Once taxable gifts exceed this amount, a federal estate tax return (IRS Form 706) along with an estate tax payment is required by the IRS.

High-income taxpayers have a unique set of issues for their tax returns, especially as they are still adjusting to the tax reform enacted just a few years ago. These issues can become very complicated and tangled without assistance from a qualified tax professional. With proper tax planning, many of these additional tax obligations can be managed and minimized if possible.

Interested in reading more about tax considerations for your clients? Check out our free eBook below.

You Need to Know for Tax Season 2022.

Canopy is a one-stop-shop for all of your accounting firm's needs. Sign up free to see how our full suite of services can help you today.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.