The American Rescue Plan Act of 2021 (ARPA) was signed into law on March 11, 2021, just barely after the Consolidated Appropriations Act of 2021 (CAA) was signed into law December 27, 2020. Along with these came even more changes to the tax law that we have barely been able to sort out after the crazy COVID year of 2020 and all the tax changes that came about as a direct result.

With so many of these changes effective for the remaining 2020 tax filing year as well as new changes for 2021, it is more important than ever to be on top of what you need to know for your clients this tax season and into the year beyond.

That’s why you should join us on Tuesday, July 27, 2021 at 1 p.m. EDT for part one of a two-part course that will cover the numerous changes to tax law from the ARPA and CAA as well effects of the CARES act and other considerations you will need in order to accurately prepare returns for your clients and advise them regarding the effect of these changes.

In the first part of this course we cover provisions that affect individual taxpayers primarily the Economic Impact Payments (round one & two), changes to extenders, unemployment, deductions, credits, and other changes to the landscape of the individual tax return, and it will enable you to quickly grasp recent tax changes and prepare you for tax season and beyond.

If you have wanted a comprehensive, easy to follow tax update course on the 2020/2021 tax law changes, this course is definitely for you

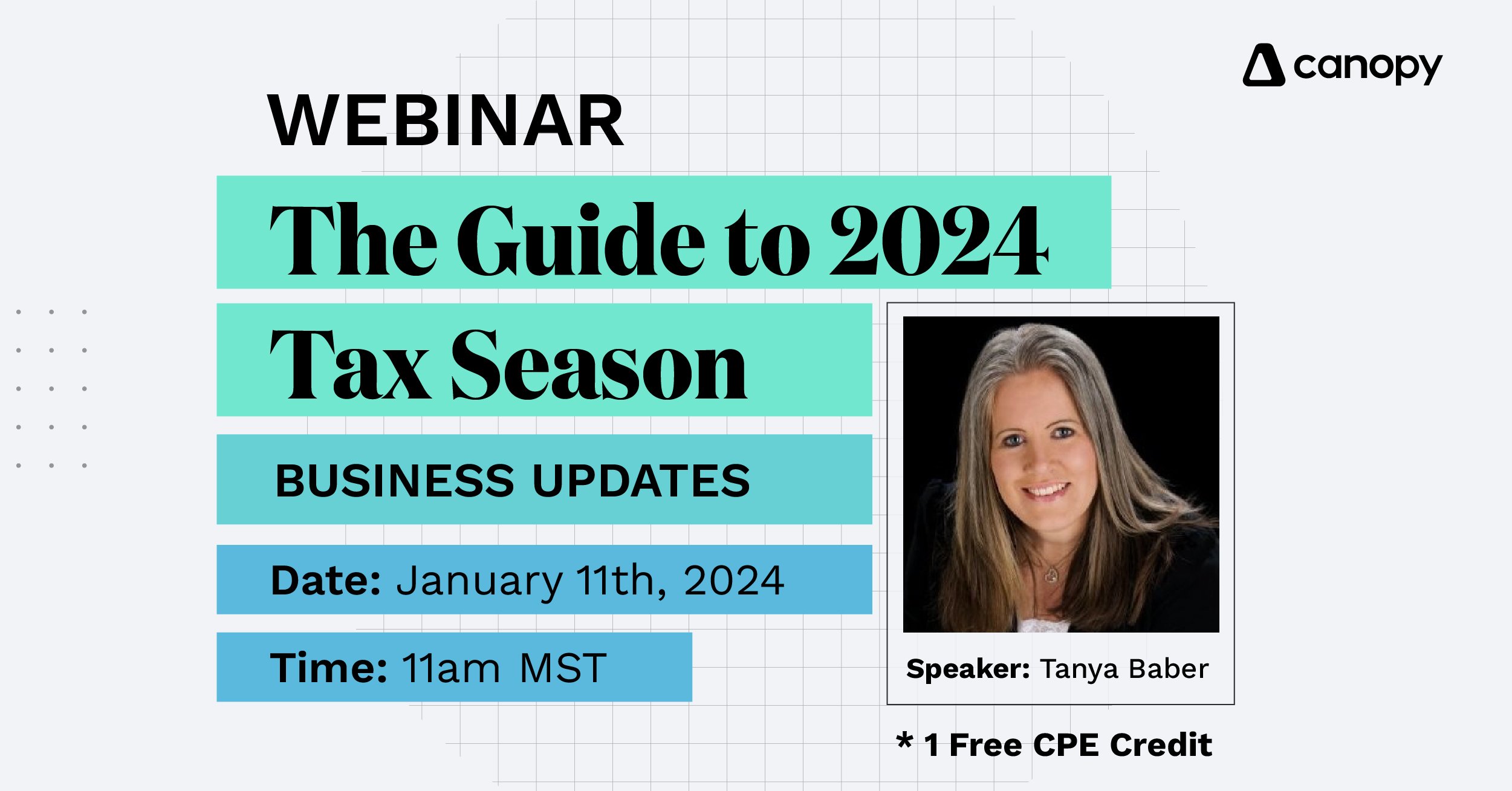

What? Tax Law Update Webinar

When? July 27, 2021 at 1 p.m. ET

Where? Online. Register here!

By attending live, you can earn one CPE credit. Not sure if this topic is right for you? Here’s a list of everyone who would benefit from the discussion:

-

- Small, medium or large-sized CPA firms

- Enrolled Agent

- Public Accountant

- Attorney

- Other Tax Preparer

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.