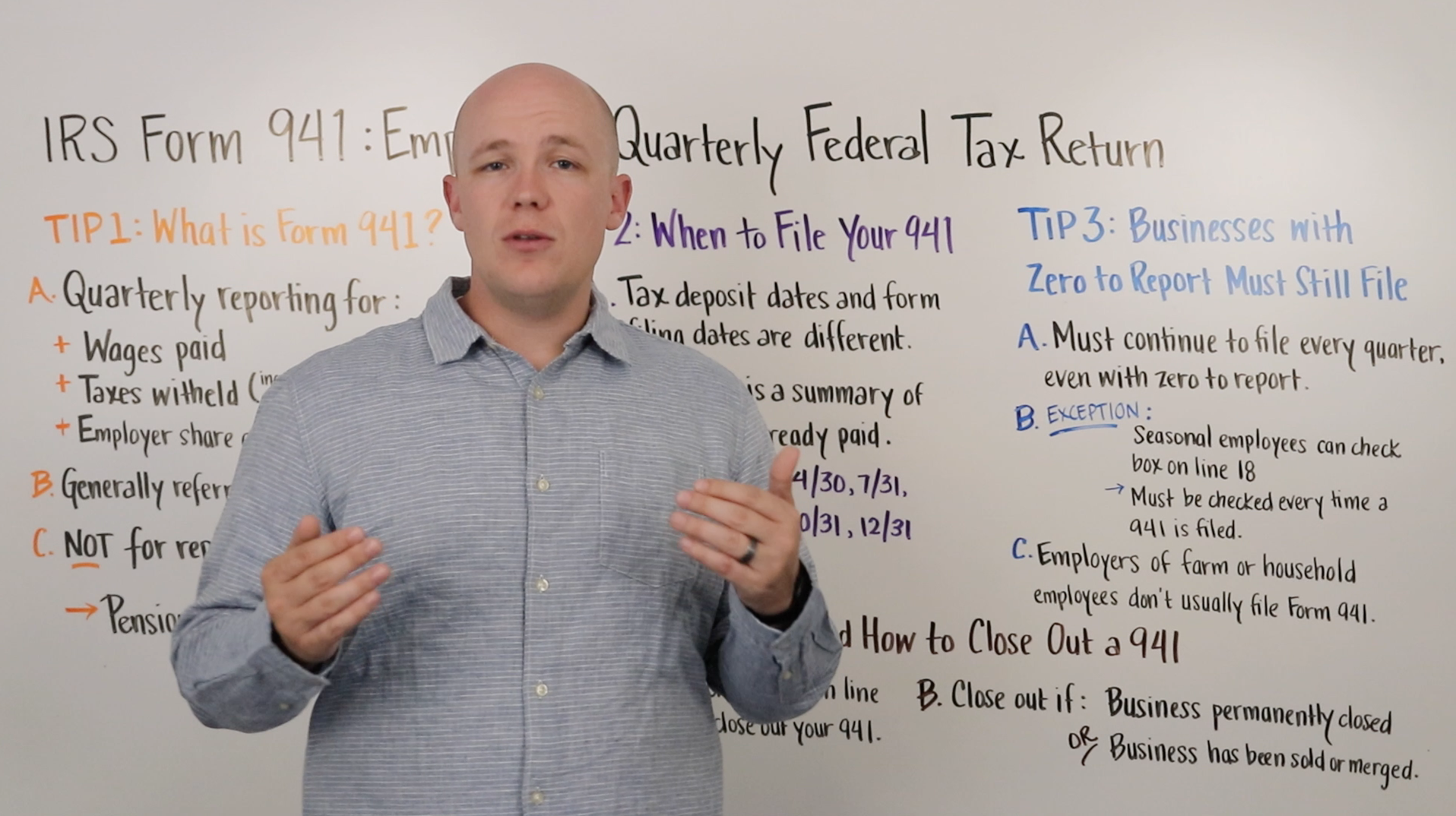

IRS Form 941, Employer’s Quarterly Federal Tax Return, is used by an employer to report federal income tax withheld from employees (including withholding on sick pay and supplemental unemployment benefits) plus the employer’s and employees’ share of social security and Medicare tax. It must be filed each quarter. The amount of taxes reported during the lookback period determines which schedule an employer must use to deposit their tax liability and how often those deposits are made. In this post we’ll take a closer look at the lookback period and deposit schedules.

Lookback period

The lookback period for filing Form 941 is 12 months, covering four quarters, ending on June 30 of the previous year.

Taxes in the lookback period are considered to be zero for a new employer.

There is a different lookback period if an employer filed a Form 944, Employer’s Annual Federal Tax Return, in the current year or in either of the previous two years. This is because this employer had tax liabilities of $1,000 or less and so was permitted to file and pay these taxes once a year instead of quarterly.

You can learn more about that here.

IRS Form 941 Deposit Schedules

While the 941 form is filed quarterly, the deposit schedules are not quarterly. There are two deposit schedules: monthly and semiweekly. An employer’s deposit schedule depends on their employment tax liabilities.

An employer is a monthly schedule depositor if they reported $50,000 or less in taxes during the lookback period. Again, the lookback period is the past 4 quarters ending June 30. In general, monthly deposits of employment taxes are due by the 15th of the following month. For example, taxes on January payments are due February 15. Again, deposit dates are not to be confused with form filing dates, which are generally the last day of the month following the end of a quarter. For example, the form filing date for the first quarter, which ends on March 31, is April 30.

An employer is a semiweekly schedule depositor if they reported more than $50,000 in taxes during the lookback period.

Filing form due dates are based on an actual date, as discussed above. However, deposits of employee taxes are due based on the payday, per the following schedule:

-

-

- If payday is on Wednesday, Thursday, or Friday, deposits are due the following Wednesday.

- If payday is on Saturday, Sunday, Monday, or Tuesday, deposits are due the following Friday.

-

Then there’s something called the Next-Day Deposit Rule. Whether you are a monthly schedule depositor or a semiweekly schedule depositor, if you accumulate $100,000 or more in taxes on any day during a deposit period, you must deposit the tax by the next business day. If this happens, that employer automatically becomes a semiweekly depositor for at least the rest of that calendar year and the following calendar year.

If a deposit due date falls on the weekend or a legal holiday, the deposit is due the following business day. A statewide holiday, however, does not delay the due date. This is because the issue is that the banks are closed on federal holidays and deposits cannot be made.

Certain employers have the option of depositing their total tax liability at the time they file Form 941, rather than on a semiweekly or monthly schedule. The following conditions must be met:

-

-

- Their total tax liability for the current quarter or the preceding quarter is less than $2,500.

- They didn’t incur a $100,000 next-day deposit obligation during the current quarter.

-

How to make a deposit

For an employer’s deposit to be considered on time, they must schedule the deposit using the Electronic Federal Tax Payment System (EFTPS), and the deposit MUST be made by 8 p.m. Eastern Standard Time the day before the due date. This is because EFTPS needs time to process the payment.

The employer may arrange for a trusted third-party tax professional, payroll service, bookkeeper, etc., to make the EFTPS deposits on their behalf. Another alternative is to call the EFTPS Help Desk on the phone to make the payments.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.